Blog

2024 Trends in finance

How finance brands are doing what matters in their industry.

Scott Lee

11 January 2024

4 min read

Insurer Lemonade harnesses the power of AI bots to make insurance more efficient. Investment platform Ellevest is on a mission to empower women financially. And through its ‘Plant Your Change’ programme, Aspiration plants trees with every transaction round-up. More and more brands realise they have a role to play in supporting people to reach their full potential while respecting the environment. In this blogpost, we share three trends from our 2024 What Matters report and highlight how finance brands can drive positive change. But contributing to positive change can take different forms. The crux lies in aligning your efforts with your brand’s vision, goals and legacy. It’s about selecting those trends that resonate with your brand to embark on a journey of positive change. Read on and explore what others are doing in this space to be inspired.

Decentralized networks

Traditional ways to get a return on your hard-earned money no longer deliver – just think about the persistently low interest rates on savings accounts. The failure of such long-trusted financial systems, which are traditionally centred around authority, hierarchy and control, is sparking a demand for more decentralized alternatives. This trend, which we label as ‘Decentralized Networks’ reflects a shift towards solutions that focus on access, transparency and autonomy. In fact, 32% of people globally believe that finance brands should act upon this trend, making it a significant opportunity space for brands to experiment with alternative ways of working that allow people more access and opportunities.

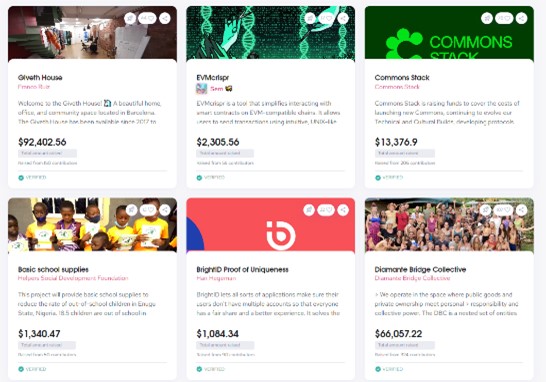

Crowdfunding, for instance, is a way to redistribute power and has evolved into an increasingly potent tool for nonprofits to raise funds and support their for-good causes. With numerous crowdfunding platforms available, nonprofits have more opportunities to reach a global audience and secure the financial support they need to make a meaningful impact. Giveth is a unique platform at the forefront of transforming the landscape of fundraising for nonprofits and projects. They stand out by offering cutting-edge open-source solutions, utilizing blockchain technology, and experimenting with decentralized governance and communication techniques. The platform prioritises transparency and accountability in all transactions. A unique feature of Giveth is its reward system: when you contribute to verified projects, you receive GIV tokens. These tokens can be used to support additional projects, improve projects ranking & increase your GIV holdings — participating in the GIV-economy.

Manifesting manifestos

While many consumers are conscious of the need for a better world, they often feel powerless on what to do or where to start. They look at brands to take a stand and lead by example, this also in finance. 39% of people globally believe finance brands have a role in leading the way and challenging existing norms by offering a fresh perspective. This is a trend we label ‘Manifesting manifesto’s’.

Amalgamated Bank, for instance, is leading the way in socially responsible banking. Their vision is “to be the financial institution for progressive people and organisations that are living and working to make the world more just, more compassionate and more sustainable”. The bank is net-zero, powered by 100% renewable energy and has a long history of providing affordable access to the banking system, supporting immigrants and affordable housing, and being a champion of workers’ rights. Amalgamated Bank is also a member of the Global Alliance for Banking on Values, a people-focused international network of banks devoted to sustainable environmental, economic, and social development.

Flip the script

Many people still don’t have access or are being excluded from financial systems, but the integration of big data analytics and AI is turning the tide, making it cost-effective to cater to a much more diverse range of people – including those who were previously left out. ‘Flip the script’ is all about challenging dominant norms and labels in society that are outdated and discriminatory. With 32% indicating that finance brands should embrace this trend, there’s an opportunity for banks and financial institutions to break free from rigid, archaic rules and recognise those who were once excluded. It’s time to give them a voice, enabling them to flourish and even change their world.

An example of a financial institution prioritising financial inclusion is WeBank. Guided by the mission, ‘Better banking for all’, this digital-only bank caters to over 300 million individual customers and 2.7 million small businesses, many lacking a traditional credit record. Historically in China, many individuals and SMEs faced challenges obtaining credit from regular banks due to inefficiencies in processing requests and inadequate risk models. WeBank, however, manages to do so in a commercially sustainable way, leveraging cloud computing and data analytics to develop superior and faster risk models. This allows them to provide better, more inclusive financial services to the broader population as well as SMEs.

Curious about the other trends shaping consumer behaviour and expectations towards brands in finance and beyond? Download our free 2024 What Matters report and embark on your journey of positive change.

Report

What Matters 2024

The 2024 edition of our What Matters report has arrived. The report takes a clear stance for change driven by a call for urgency, as new research reports 8 out 10 people worldwide are worried about the future and feel brands need to take responsibility.