Blog

Beyond transactions: four trends shaping the future of finance

Our four finance trends to watch: mindful money, curated well-th, rewarding relationships and feel-good finance.

Scott Lee

17 December 2024

6 min read

What do people expect from their bank these days? A simple app? Seamless transactions? That’s not enough anymore. As highlighted in our What Matters 2025 report, consumers are shifting towards intentional living – demanding simplicity, control, connection and purpose across all aspects of life, including their finances. This shift is reshaping the financial industry, inspiring brands to build more mindful, empowering and engaging relationships with money. Here’s how.

Simplicity & mindfulness: Mindful money

The days of thoughtless spending are fading as people adopt financial mindfulness – a deliberate and conscious approach to money. Consumers want to understand their financial habits and make deliberate decisions, so they’re looking for tools that simplify financial management and help to align their habits with long-term goals.

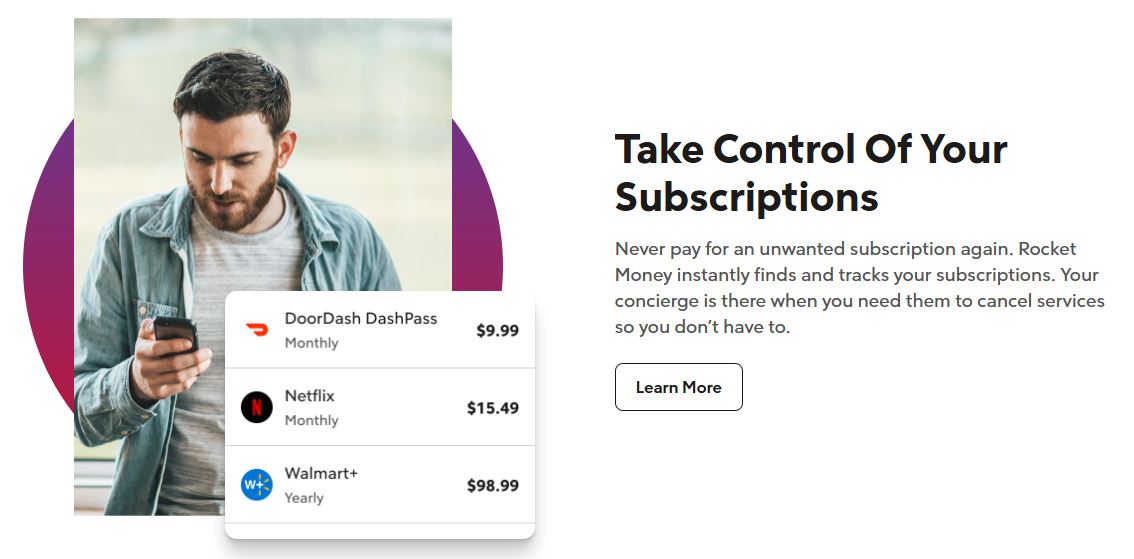

Apps like Allo and Aura embody this mindset, combining behavioural psychology, emotional support and personalised coaching to ease financial anxiety. Similarly, tools like Rocket Money simplify mindful spending by eliminating unwanted subscriptions and automating savings – giving users clarity and control over their budgets.

Books such as Mindful Money and The Mindful Millionaire echo this sentiment, exploring how to achieve peace and prosperity through money management, reminding us that money should be a tool, not a source of stress. Jonathan K. DeYoe, author of Mindful Money, captures this idea perfectly: “Mindful money is a tool you can use to support your lifestyle and reach your goals without making it the centre of your life.”

For today’s consumer, mindfulness in finance isn’t about restriction; it’s about freedom – making spending decisions in line with one’s values and goals to achieve peace of mind and prosperity. As a result, brands need to simplify financial management with intuitive, user-first designs that reduce complexity and build confidence.

Autonomy & control: Curated well-th

From playlists to personalised shopping, Millennials and Gen Z expect financial tools that reflect their individuality. They are tired of platforms cluttered with irrelevant features and demand autonomy and control in their digital lives.

Customisable platforms like Revolut are leading the way, letting users personalise their accounts, design debit cards and align investments with their personal interests and values.

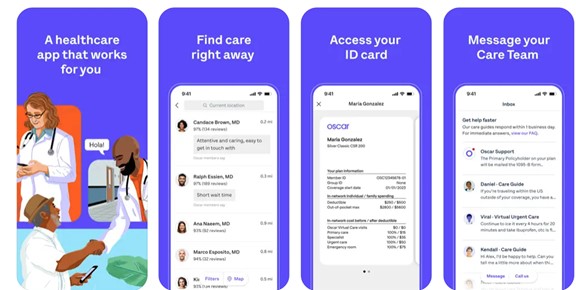

But the rise of tailored solutions isn’t limited to banking. Health insurers like Oscar Health leverage AI to customise plans based on medical history and lifestyle, offering targeted wellness suggestions like preventive screenings, routine check-ups and vaccinations. For instance, if a policyholder has a history of heart disease, the system may recommend regular cardiovascular screenings, fostering early detection and better management of chronic conditions.

Likewise, Hippo Insurance leverages AI to analyse home risks, ensuring policies meet individual needs.

This move towards tailored banking and insurance marks a radical departure from off-the-shelf white-label interfaces and rigid product bundles. Instead, it empowers customers to remix and reconfigure finance tools to fit their unique lives.

Authenticity & connection: Rewarding relationships

Beyond autonomy and control, customers are craving for meaningful relationships. In a sea of surface level interactions people are looking for more interactive and empathic relationships, where they feel understood. Surprisingly, technology can play a key role here. In a recent study evaluating responses to patient questions, ChatGPT was rated significantly higher for empathy compared to physicians. Similarly, in the finance industry AI can be used to infuse authenticity and connection. This led to a new term ‘live banking’, coined for a banking model that integrates digital technology with real-time human interaction. Customers can quickly resolve routine issues with AI or seamlessly escalate to human advisors who understand their emotional and financial contexts.

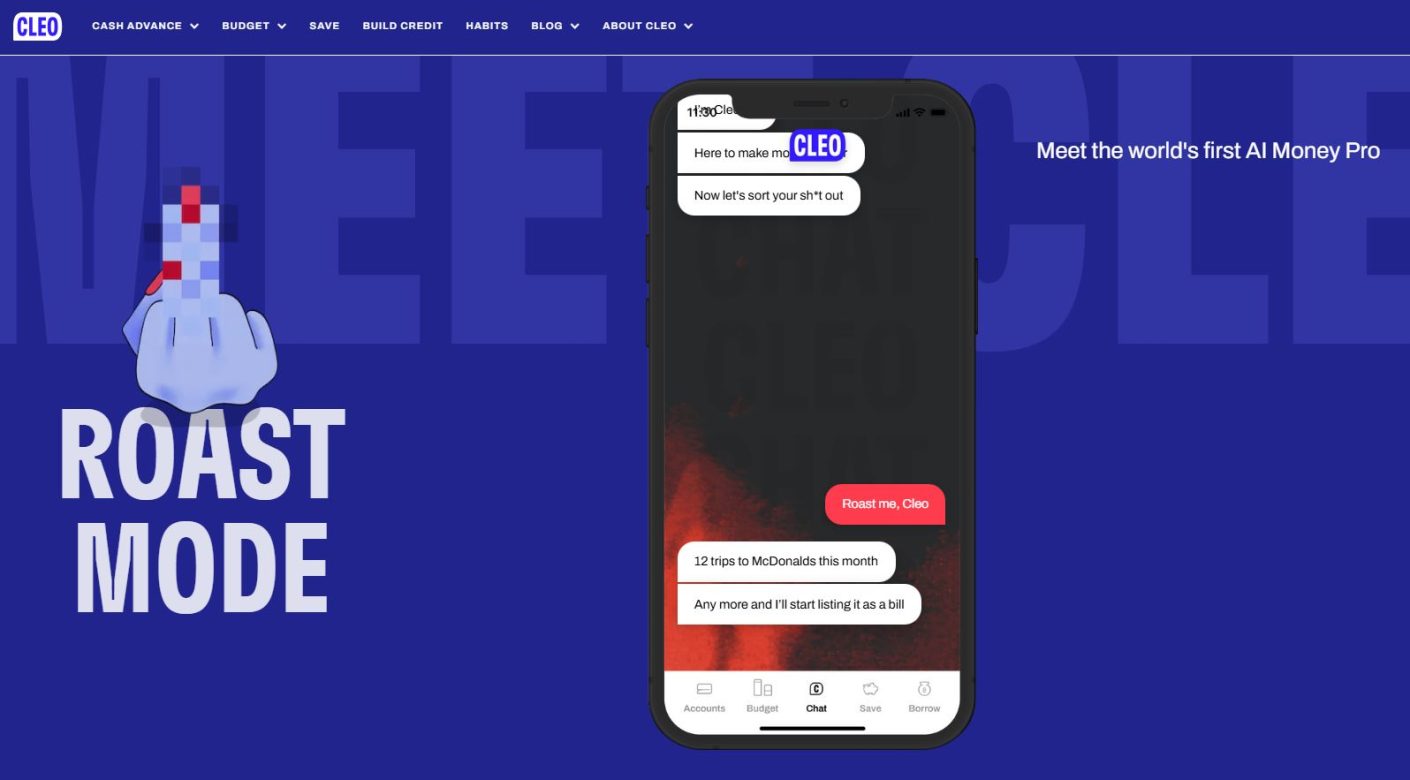

In this context, platforms like Cleo stand out for infusing humour and personality into digital finance. Cleo’s playful AI assistant employs a chatty and informal style to create a friendly atmosphere. The app is designed with a ‘sassy’ attitude, which allows it to deliver financial advice in a light-hearted manner. For example, through its ‘Roast Mode’ feature, Cleo delivers playful spending critiques, making financial advice feel less like a lecture and more like chatting with a friend.

People’s craving for authentic connections has also spurred social banking – transforming financial brands from solitary service providers into community hubs where customers can learn from one other, share financial best practices and even co-develop new product features. In Thailand, LINE BK integrates financial management into the LINE messaging app, enabling seamless, personal money conversations among friends and family. This normalises discussions about money, making it easier to split bills, pay back loans or share expenses in a friendly manner. Likewise, Hang Seng Bank’s Family+ Account helps families manage their finances. The brand addresses diverse family structures, offering tailored solutions for shared goals, from education to retirement.

By blending AI-driven empathy with human interaction, financial brands can foster authentic connections that go beyond transactions. From playful advice to community-driven tools, it’s about making people feel understood, empowered and connected.

Joy & purpose: Feel-good finance

In today’s high stress world, people want their financial providers to deliver more than seriousness. Small moments of joy are essential to ease the pressures of modern life. So, many finance brands are now flipping the script, adding joy to the typically dull experience of managing money. Monzo’s recent ‘Money Never Felt Like Monzo’ campaign perfectly captures this shift, using whimsical contrasts – like a blissful harp versus screeching nails on a chalkboard – to show that banking can actually feel good. In the same way, Australia’s digital Up Bank attracts users with vibrant tools that gamify savings and simplify financial well-being.

Gamification is also central to India’s CRED, where paying credit card bills unlocks rewards and exclusive experiences. This approach makes even routine financial tasks engaging and rewarding – leading to a 25% increase in on-time payments.

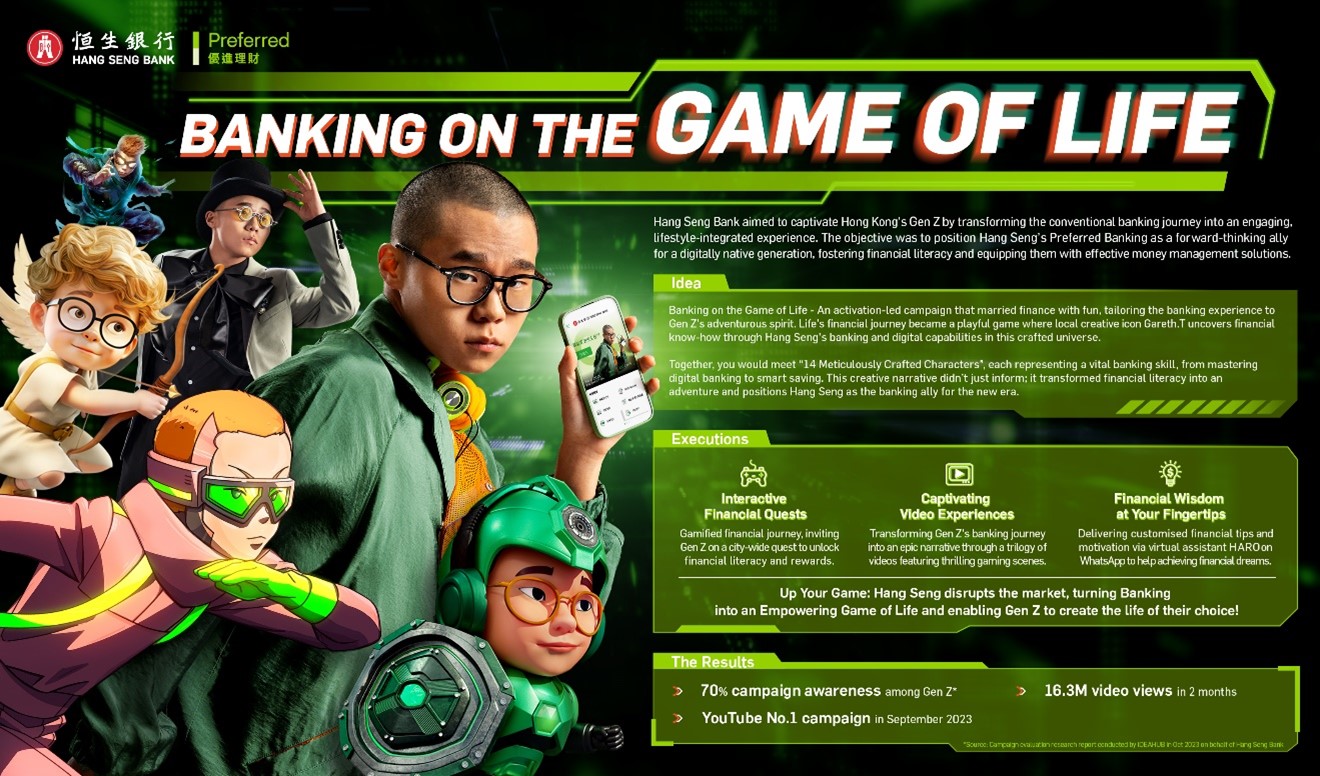

Also traditional banks are finding fresh ways to attract younger customers, blending education, rewards and interactive experiences. In Hong Kong, Hang Seng Bank launched its “Be a game changer and ‘carry’ yourself!” campaign. Driven by research revealing that 70% of consumers prioritise attractive financial rewards when choosing banking services, Hang Seng gamified its digital banking platform with daily financial missions. Customers could complete these missions – like exploring investment options or managing transactions – to earn entries into a daily lucky draw, boosting participation with up to 10 chances to win. Adding to the excitement, Hang Seng scattered QR codes across Hong Kong – including MTR offices, promotional posters and outdoor ads – turning the city into a financial scavenger hunt. By scanning these codes, customers could draw digital game cards, seamlessly blending real-world interaction with online banking engagement.

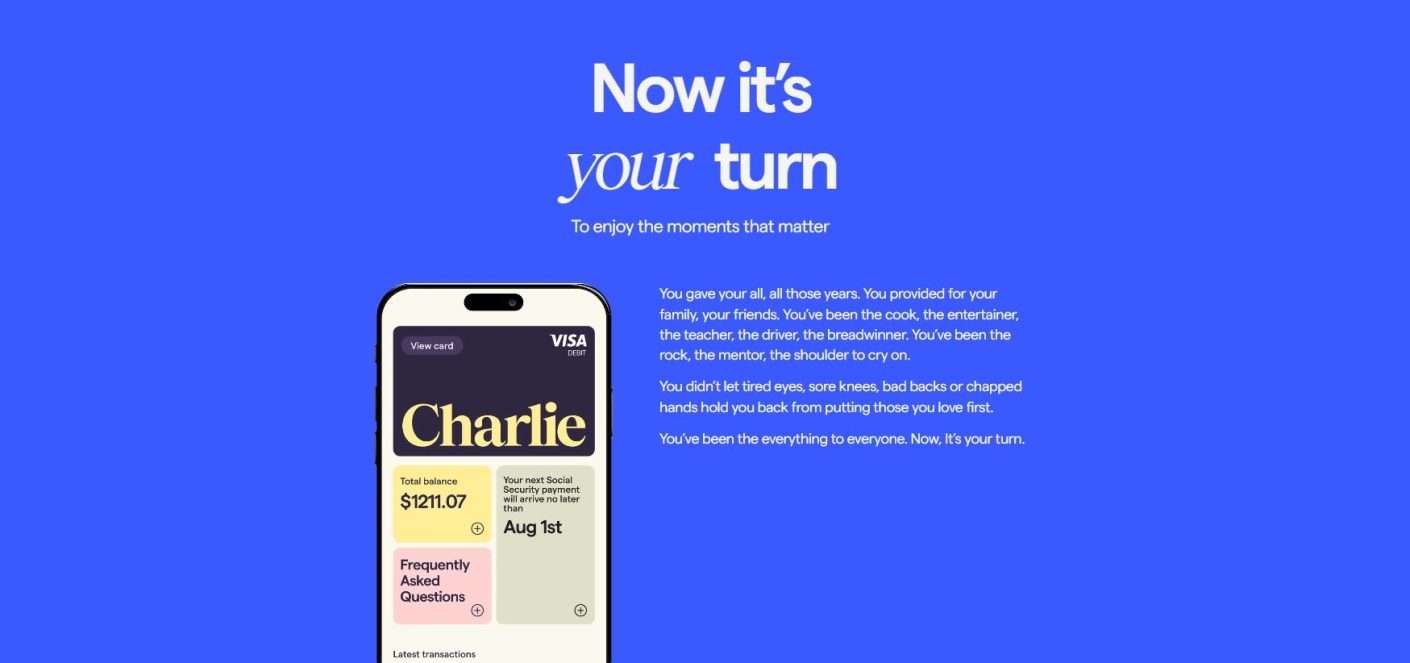

This feel-good finance trend extends to seniors, too. Platforms like Charlie cater to older adults with user-friendly tools for managing Social Security and savings, empowering them to navigate finances confidently. On top, they encourage seniors to get the most out of life, fully enjoying the moments that matter.

To summarise, in 2025, the financial industry is no longer just about transactions. Brands are embracing a human-centric approach that prioritises mindfulness, personalisation and connection. Whether through AI-driven empathy, gamified experiences or tailored tools, finance is becoming more intuitive, rewarding and aligned with people’s lives.

As consumers redefine their relationship with money, financial brands have an opportunity to lead with purpose – helping individuals feel empowered, understood and fulfilled in every financial decision they make.

REPORT

Get your free copy!

For more insights into what matters to people in 2025, request your FREE access to our 2025 What Matters report.

Request your free access