CASE

Why taking a different perspective on your customer matters

How a new segmentation model helped Nedbank better understand its customers and provide more targeted services.

How it started

Nedbank, one of South Africa’s top 5 banks, wanted to grow its insights in and understanding of its middle-market segment. As part of this, the bank needed a new segmentation model that would inform all future product, service and solution development.

How we inspired change

During the first phase of the research programme, we invited 100 Nedbank customers to participate in a one-week online consumer community. Through this online qualitative exploratory study, we immersed the Nedbank team in their customers’ broader-lifestyle wants and needs, to shape the new segmentation. This digital approach offered the research team a wider access to more information, making the new segmentation model more accurate (and faster!).

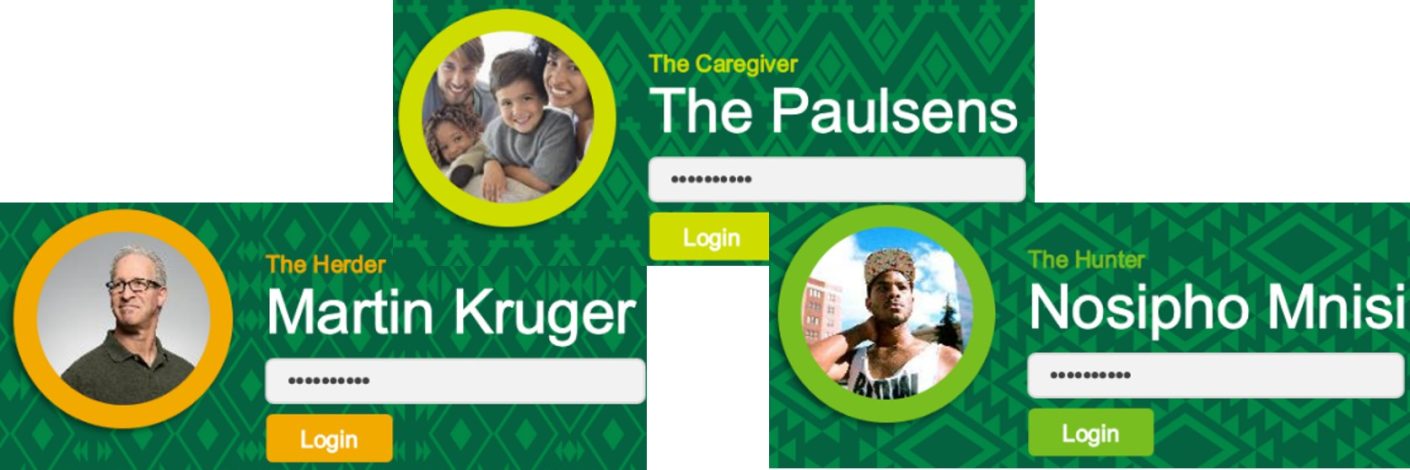

After having identified a large list of needs and wants, the research team deployed a quantitative study to add numbers to the feeling. This allowed them to adequately rank and group not only consumers’ desires, but also their unique profiles. This gave birth to Nedbank’s three new validated middle-market segments: The Herders, The Caregivers, and The Hunters.

How it lives on

Doing a needs-based segmentation proved to be infinitely more reliable and useful than the historic demographic-based segmentation.

The results from the various quantitative and qualitative consumer engagements allowed Nedbank to delve deeper into the consumers’ values, needs and wants. It also helped them create a bespoke suite of products that speaks specifically to the personal preferences of the newly identified segments.

This is currently the de-facto segmentation model used by the bank to categorise new customers, informing its product ideation, prototyping, roll-out phases and also its marketing collateral.

Let’s connect